Updated on 18th July 2020

Henderson Land is a listed property developer in Hong Kong and China since 1981. They own the International Finance Centre complex in Hong Kong and the World Financial Centre in Beijing. As seen from the below image, they have listed subsidiary Henderson Investment Limited and 3 listed associates, including The Hong Kong and China Gas Company Limited (it has equity in Towngas China), Hong Kong Ferry, and Miramar Hotel and Investment. We held our wedding at The Mira (Hong Kong) and Peach Garden @ Miramar (Singapore). Both are related to Miramar but as you can see, the cheapo (or the FIRE mentality) me wanted an affordable wedding in Singapore whereas my wife wanted a grand wedding which was difficult to break even. I should have bought the Miramar Hotel and Investment shares few years back.

Subsidiaries and associates

Business in Hong Kong

1- Land Bank

The total land bank of Henderson Land in Hong Kong amounts to approximately 24.5 million sq ft in the total attributable gross area as of 31 December 2019. This consists of development sites, investment properties, and hotel properties.

There is a total of 44.9 million sq ft of agricultural land over various districts in New Territories as of 31st December 2019. This is the largest agricultural land bank among all property developers in Hong Kong.

2 – Property Development

Property development is focused on exceptional locations along with mass transportation routes, waterfront, and green open space. The Group won the bids for three waterfront residential sites on former Kai Tak airport runway through various joint ventures, adding 0.7 million square feet to its development land bank in Hong Kong. The Group owns six residential development projects in Kai Tak area, representing a total of 1.9 million square feet.

3 – Property Investment

The investment portfolio consists of offices and shopping malls which account for 90% of the gross floor area. The International Finance Centre, Manulife Financial Centre and large scale shopping centres are located near to MTR stations on Hong Kong Island, Kowloon and throughout the New Territories.

Business in China

The group is looking for development projects in first-tier and second-tier cities to expand its land bank. China investment portfolio comprises international standard Grade-A office and retail spaces in major cities of Beijing, Shanghai, Guangzhou and other provincial capital.

Net Asset Value

NAV is deducting the total liabilities from the total assets of the company and divided by the total number of shares.

Formula of NAV = (Total Assets – Total Liabilities)/Total Number of Shares

NAV of Henderson Land = HKD 66.2778

Current share price = approximately HKD 30

Discount to NAV = 45%

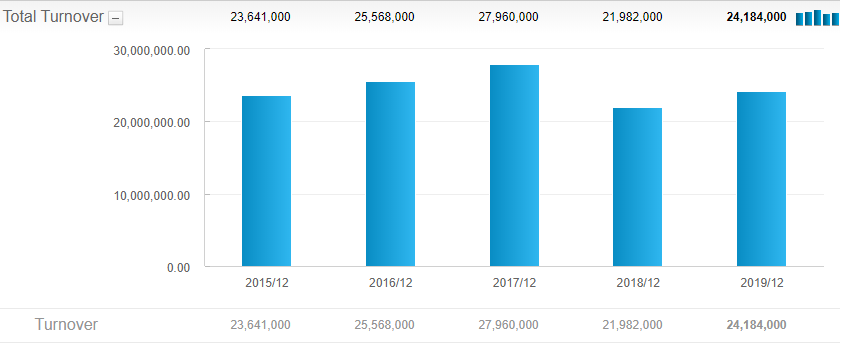

Turnover

The Turnover remains flat throughout the last 5 years.

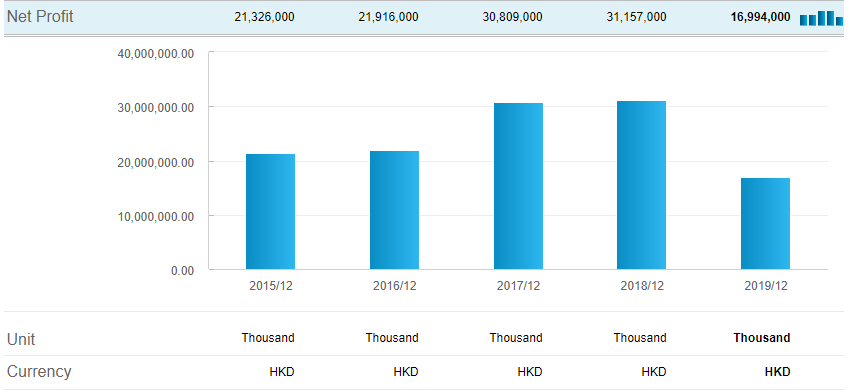

Net Profit

The Net Profit almost dropped by half from FY2018 to FY2019. Net profit growth dropped by 45%. The dividend yield since FY2018 has increased to 6.35% but back then the payout ratio was only 27.95% and FY2019 dividend yield is maintained around 6% and the payout ratio has increased to 51.28%. We need to question the dividend sustainability if this continues to deteriorate.

Debt Level

The total debt to equity level remains low at 28.71% in FY2019 but it has been increasing since FY2015 at 20.73%. ROE has decreased to 5.3% in FY2019 which is the lowest for the last 5 years with an average of around 9%. Return on Assets is low at 3.73% which is the lowest for the last 5 years with an average of around 6%. The question to ask, why FY2019 we see such deterioration? Is it applicable to other major developers in the region? Another trend that you have seen is increasing the debt level and the net profit is falling at the same time while they maintain the dividend level. The business is operating in a more challenging environment due to the pandemic and social unrest.

Conclusion

In a future article, I need to look into Sun Hung Kai Properties to see how does Henderson Land pit against other developers.

Leave a Reply