Overview

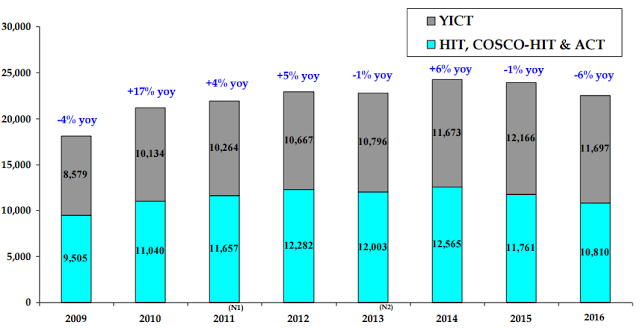

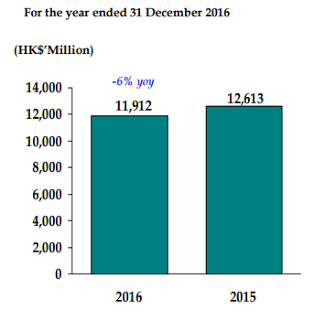

2016 full year throughput of HPH Trust’s deep-water ports was 6% below last year. YICT’s throughput was 4% below last year. Combined throughput of HIT, COSCOHIT and ACT dropped 8% yoy. Although outbound cargoes to US and EU showed a positive trajectory in 2016 and grew at a faster rate in the fourth quarter of 2016, YICT’s throughput overall declined compared to 2015 as it was adversely impacted by the decrease in empty and transshipment cargoes. The decline in HIT’s throughput was mainly attributed to weaker intra-Asia and transshipment cargoes. Revenue and other income was HK$11,912.3 million, HK$700.5 million or 6% below last year. 2016 full year NPAT was HK$2,954.0 million, HK$90.6 million or 3% below last year. NPAT attributable to unitholders was HK$1,713.6 million, HK$31.3 million or 2% below last year.

Outlook and Prospects

As a result of the strong rebound in economic activity in the US in the second half of 2016 supported by robust employment data, outbound cargoes to the US escalated in the fourth quarter of 2016. However, there remains a high level of uncertainty on the policy stance of the new US administration and its domestic and global ramifications on the US economy and trade in 2017.

The moderate uplift in outbound cargoes to Europe when compared to 2015 is largely supported by the stable, albeit slower pace of growth of the European economies in 2016. However, continued weak consumer sentiment and high unemployment rate is expected to hinder the speed of economic recovery in Europe and the pickup of the European trade in 2017.

In addition to the economic performances of the US and Europe, HPH Trust’s performance is also impacted by the outcomes of the structural consolidation within the container shipping industry. The service rationalization of various global shipping alliances has negatively impacted the transshipment volume of both HIT and YICT in 2016.

Shipping lines continue to deploy mega-vessels to achieve economies of scale, reform their carrier alliances to improve efficiency, control costs and expand the coverage of vessel-sharing schemes to enhance competitiveness as seen by the recent announcement by Japan’s big three shipping groups, Kline, MOL and NYK to merge their container shipping businesses. HPH Trust is well positioned to be the preferred port of call for mega-vessels given its natural deep-water channels and unparalleled mega-vessel handling capabilities. The recently signed co-management arrangement for the 16 berths across Terminals 4, 6, 7, 8 and 9 in Kwai Tsing, Hong Kong is expected to deliver cost and operational synergies as a result of a more efficient use of the facilities and manpower resources which will enhance the overall competitiveness of the services offered by HPH Trust in 2017. The acquisition of HICT in 2016 is expected to provide additional handling capacity and generate operational synergies with Yantian International Container Terminals through sharing of resources and better utilization of port and related facilities in 2017.

Key Business Update

Revenue

Total Capex – Need to explore throughout all the years

Distribution

DPU for the year ended 31 December 2016 is 30.60 HK cents which is about 9% yield based on USD 0.435 market price.

Financial Results

Due to changes in depreciation to a shorter duration, the depreciation amount is increased. Staff costs decreased from 306.6 to 297.4 in 2016 which is 3% improvement. I look at Singapore companies such as SIA engineering, they increase staff cost at the expense of shareholders whereas HK and US companies will run their company more prudently by keeping cost low. Such is the typical lives of employees.

The Profit after Tax for FY 2016 in my context (prudent) = 2954 – 70.5 – 357 = 2526.5

Profit after Tax for FY 2015 = 3044.6 – 155.5 = 2889.1

We see a decrease of 12.5%

I see that both current liabilities and non-current liabilities increase by approximately 14%.

Cashflow Statements -> Operating Cashflow increases but it is due to tax savings. Nonetheless, the cash generated from operations is flat compared to the year before. It is good sign to see that CAPEX is been reduced but there can be a limit before the equipment needs to be renewed/repaired/replaced.

It is interesting to see that the total borrowings for FY 2016 is lesser than FY 2015. Is it a sign that things are turning around? HPH Trust USD has higher free cash flow than last year.

Conclusion

I believe the company has sufficient cash to continue to pay dividend.

Leave a Reply