I attended a talk by CPF on planning for your retirement with CPF on 8th March 2020 which lasted from 2.30 pm – 4 pm, followed by Questions and Answers section. This article will summarize some of the key ideas of the talk.

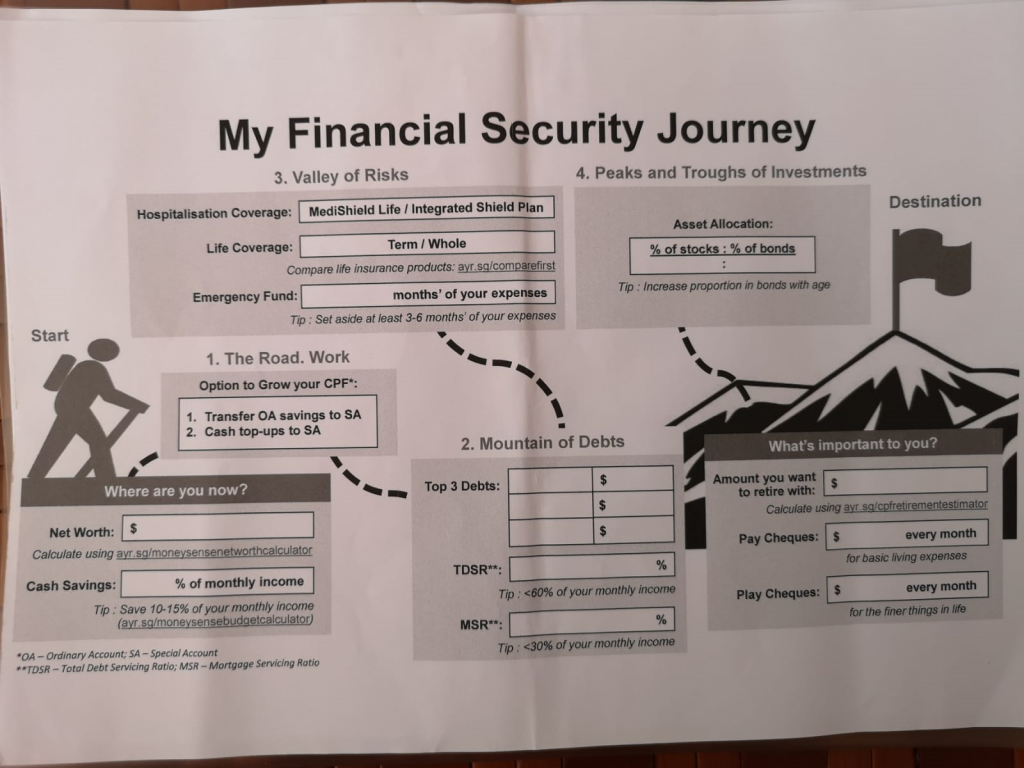

In the morning session which I missed, I chance upon a very useful image from CPF. The session topic is called “My Financial Security Journey”. From the start of the journey, you need to understand where you are now. What is your net worth? What is your saving rate? When you transit on this journey, have you bought your property? If you have paid down your property or have excess, you use cash to top up your CPF Special Account (SA) or transfer Ordinary Account (OA) savings to SA. Then you will transit to Mountain of Debts where you list your top 3 debts to identify your debt level (debt to income). After surviving the Mountain of Debts, you will transit to Valley of Risks. This is where you need to get yourself protected and set up your emergency fund. My view on this is Valley of Risks should be the first step you need to go through before you start another journey. After putting all the protection in place, then you can allocate excess into investments.

Coming back to the session which I attended, the 3 basic needs in retirement are 1) Retirement Expenses 2) Healthcare Costs and 3) Housing. In your retirement years, you will want to have 3 types of Retirement Cheques. They are 1) Pay Cheques 2) Play Cheques and 3) Post-Dated Cheques. Pay Cheques will cater to your meals, telecommunication plan, and transportation cost. Play Cheques will cater to your travel plan and hobbies. Post-Dated Cheques are meant for legacy planning which is to leave for your love ones.

I was very impressed when CPF shows an image that explains how to plan for your Pay and Play Cheques. It shows that you should start to accumulate today and to achieve S$2,500 per month of retirement income, you need:

1) CPF Life: about S$1,400 (Full Retirement Sum)

2) Annuity: S$300

3) Investment: S$300

4) Cash Savings: S$300

5) Part-time work: S$200

These are your multiple sources of retirement income. Accumulation stage is not the hardest but during the withdrawal stage (drawing down on your savings during retirement) is the toughest to manage.

Your CPF Accounts

As an employee or employer, you will accumulate CPF contribution as you work. You earn interest of up to 5% p.a. on your CPF savings. Over time, your CPF will grow with the power of compound interest and convert into your Pay Cheque by joining CPF Life to receive lifetime monthly payouts. Ordinary Account earns up to 3.5% p.a., Special Account (SA) earns up to 5% p.a., Medisave Account (MA) earns up to 5% p.a., Retirement Account (RA) earns up to 5% p.a. The extra 1% interest is paid on the first S$60,000 of your combined balances of which up to $20,000 comes from OA.

For example, if you are below 55 years old, you have OA of S$30,000 SA of S$100,000 and MA of S$40,000. The maths work based on the following:

OA:

$10,000 => 2.5%

remaining $20,000 => 2.5% + 1%

SA:

$60,000 => 4%

remaining $40,000 => 4% + 1%

MA:

$40,000 => 4%

For example, if you are 55 years old and above, you make up to 6% interest for first $30,000, 5% for next $30,000. Let’s say you have RA = $181,000 OA = $30,000 SA = $0 and MA = $60,000.

RA:

S$121,000 => 4%

RA first S$30,000 = 4%+2% = 6%

RA next S$30,000 = 4%+1% = 5%

OA => 2.5%

SA => 0 x 4%

MA => 4%

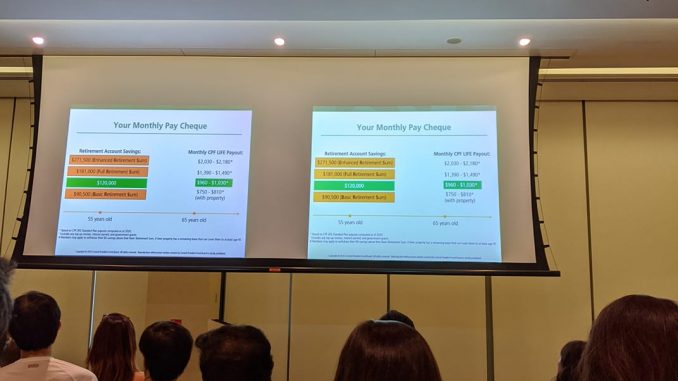

Your Monthly Pay Cheque

Retirement Account Savings as of 2020 are:

$90,500 is your Basic Retirement Sum (BRS)

$181,000 is your Full Retirement Sum (FRS = 2 x of BRS)

$271,500 is your Enhanced Retirement Sum (ERS = 3 x of BRS)

You need to achieve this by age 55 years old.

Sale of Property After 55

If you had used your CPF savings to buy a property, you need to refund the principal amount withdrawn for the property plus accrued interest or amount withdrawn from RA. It will be used to help you set aside your FRS in the RA. The balance of the housing refunds will be paid to you in cash. If you have sold your property at or above market value and your proceeds are insufficient to make up the amount you have withdrawn, the accrued interest and pledge amount (if any) will not be required to refund the difference in cash. To buy the next property, if it can cover you to at least 95 years old, you can use savings in OA and RA excluding any top-up monies, interest earned and government grant above BRS to finance the next property. If the property does not cover till at least 95 years old, you need to set aside your FRS in your RA, SA including the amount used for investment and OA before you can use any excess OA savings towards your next property purchase.

A Cheque Book that never stops paying

There is increasing life expectancy in Singapore. 1 in 2 will live till age 85 and 1 in 3 will live till age 90. The various CPF LIFE plans are:

1) Standard Plan

2) Escalating Plan

3) Basic Plan

Standard Plan gives a higher level of monthly payouts, Escalating Plan gives monthly payouts that start lower but increase by 2% yearly and Basic Plan gives lower monthly payouts. Any unused annuity premium and CPF savings will be distributed to your beneficiaries after your death. The Basic Plan monthly payouts will reduce gradually when your combined CPF balances (including unused CPF LIFE annuity premiums), fall below $60,000. This is due to less extra interest earned.

Leave a Reply