Updated 5th November 2022

I was intrigued by the Facebook ads which show how one can own multiple properties and create passive income from them. This is the key objective when I attend not one but two workshops. The first one is from IQuadrant and the other is with Markoandfriends.

Germaine Chow is the lead trainer at IQuadrant, with her ex-air stewardess look and figure, it is the key reason when she stands on the stage, she captivated all the men’s attention. Sorry for digressing and hope that my wife doesn’t read this section. She started to moonlight as an internet marketer when she was working as an air stewardess with SIA. That’s how she met her husband. She explained that she went through some adversity when her business went bankrupt.

Through desperate situations, one becomes very creative. Perception is not equivalent to reality. She emphasized that she wanted an investment vehicle that put her in control and it is passive. That was the reason why she chose property.

She asked the crowd what the ideal passive income required to retire. The group gave an average of SGD 9,000/month.

Assume 1 unit of property produces $1,500 per month

We will need 6 units to produce the required income.

Due to all the various restriction, it is no longer viable to flip residential properties in Singapore and the rental yield of both commercial and residential units are not attractive enough. Furthermore, for residential units, you will be subjected to Additional Buyer Stamp Duties and penalties (tax) if you sell earlier. Therefore it is not a viable investment strategy for passive income through rental yield.

The more attractive industrial properties can have a better capital appreciation and rental yield. Hope and prayer are not an investing strategy. You need to buy undervalue units. An asset is defined as gaining positive free cash flow whereas a liability is taking money out of your pocket.

One rule of thumb is minimum rental yield required is 4% for industrial buildings. This is after accounting for maintenance fees, mortgage, and property tax.

As it is a preview only, Germaine only shared one strategy which is to go for an industrial building with a 95% occupancy rate. If it is 95% occupied, it indicates that there is demand for the property and you can determine who your neighbours are already. For the new project, you pay upon completion of the unit, it will take 3-4 years for tenants to fill up. A new unit does not mean it can capture tenants. You will not know who are your neighbours.

There are good and bad debts. If you buy a unit for 1m and sell at 1m 30 years later, do you make money or lose money? It depends. Germaine presented the following:

Rental $4,000/month

$4k x 12 months x 30 years = $1.44m

On the surface, you make money right? However, she did not consider interest expenses.

She further elaborates on using Debt. For a 1m unit, you use a down payment of 200k.

Rental $4,000/month

Mortgage $800k -> $3k/month

Cash flow = ($4k – $3k) x 12 months x 30 years = 360k

$360k + $800k = $1.16m

$1.16m/ (200k x 30years) = 19.3% ROI

Mr unlucky scenario

Buy at 1m and 30 years later sell at 800k

downpayment 200k

Rental 3,600/month

Mortgage 3000/month

+ve cash flow = (3,600 – 3,000) x 12 months x 30 years = $216k

$216k + $600k =$816k

ROI = 816k/(200k x 30 years) = 13.6%

She explains this is the power of leverage, making our money work harder for us. She showed one of her personal investments below:

Bought the unit @ 488k

Cash outlay 97.6 k

4 years of passive (rental) income = $1616/month x 48 months = $77k

Principal paid = 874/month x 48 months = 41,952

Assume 15% capital appreciation = 73,200

Less (stamp duties, lawyer, company maintenance fees) = 40k

Net Profit = $152,720

5 components to be successful property investors

- Really want to own a property

- Practical optimist

- Earn 2k – 5k/month

- The safe and predictable path

- Team player

Spot Gold Location – Germaine explained how an industrial unit could be divided into 3 sub-units with 2 separate entrances for the two main units and an individual door for the 3rd unit. This way she increased rental income from the original $2,300 to $3,450 (from 3 units). She further explains it is important to add value through renovation and decoration. Always value adds to others. This is the biggest takeaway.

She touches on negotiation tactics by creating long-term win-win situations. When you want to buy a unit, you need to give what the owner wants.

She briefly touches on raising funds, using Other People’s Money as the key to owning multiple properties. You need a legitimate entity to return the money, a legally binding contract needs to be in place, and it is important to position yourself as someone credible.

At Markoandfriends’ preview, I paid $27 for the session. The only thing I learn is FAST. FAST stands for Furnish, Advertise as Owner, Seed, and Take. Advertise as Owner means you advertise as Owner and pay a commission to the property agent, he will be incentivized to look after your interest as well. The seed represents different tenants who will have different needs, you need to know what is in the market. Take means just take the first decent offer because any waiting will be an opportunity cost and loss of income. For example, if you are looking for $3,000/month and they counteroffer $2,800/month just take first.

Strategy – group together, set up a company, and buy properties

Story – Mindset

State – Belief

Germaine is an ex-student of Marko. She came out to start her own training which replicates what Marko taught. I will say Germaine did a better job to teach more during the preview but Marko is the original teacher.

Updated on 5th November 2022

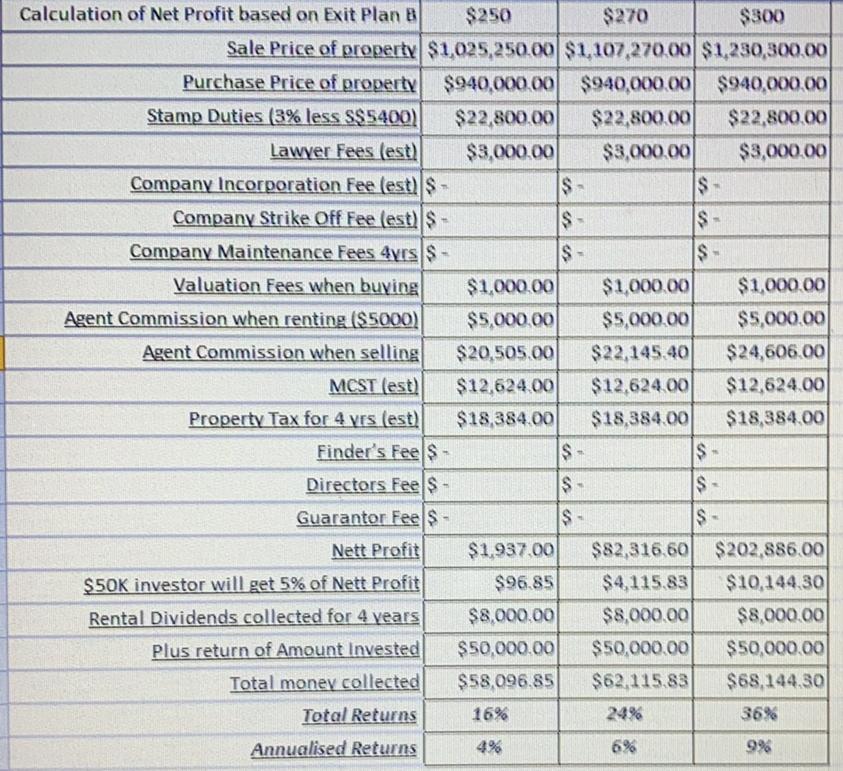

This is from one of the students who went for the Marko and Friends program. This is taking into consideration all the fees and as a shareholder how do you split the profit? Property tax is 10% on non-residential properties which must be taken into account. The rental dividends are recommended to be kept till the end of divestment to be split among the shareholders.

Hmm so essentially, you’ll be pooling $ together to set up a company & this gives you leverage to get a loan from bank. Then invest in industrial properties? Very interesting.

I did not sign up for the course but I have a friend who claims to be drawing a constant rental income after attending Marko’s course.

Take a look at a post by my friend Douglas Chow – https://www.99.co/blog/singapore/can-you-really-own-20-properties-with-no-cash-down/

You got to weigh your pros and cons. Do your homework!

I think on their personal example they bought in early when the industrial market just picked up, its quite saturated now, I also bought in quite early and good rental is not easy to come by. That said if you get a good tenant then its great as they tent to be with you for 3 – 5 years.

From their scenarios the selling price seems too optimistic, most of these industrial are 30/60 years leasehold was depreciation accounted for?

Mr unlucky scenario

Buy at 1m and 30 years later sell at 800k

Thank you for your comment, I went for a Scam Buster free seminar by Douglas Chow. What I learned coincides with your observations, their view on the market is overly optimistic to attract yield investors. People are sold on the idea of passive income through properties rental.

I asked the question what if interest rate rises, the answer from Germanie Chow was rental income will rise accordingly. Do you agree with her?!

Property investment ties closely with economic cycle we are in. I feel that they are making their money from conducting the course and using the money to quickly pay down their properties if they do own them. Always DYODD.

Apologies I missed your reply, on the below I don’t agree with that. From what I have observed rental in a development tents to stagnate around a particular level (due to many empty units) if the owner renovates for the tenant its money out of their pocket, generally industrial unit tenants do not do intensive renovations as they move around quickly so locking current tenants in is also a challenge (hence increasing rent is also tricky) – both of which I have experienced before.

“I asked the question what if interest rate rises, the answer from Germanie Chow was rental income will rise accordingly. Do you agree with her?!”

Adding to this buying a undervalued unit at a development which is 95% occupied is very unlikely (no one will sell a good yield unit cheap), also the “Spot Gold Location” approach is also skirting BCA regulation of Industrial usage by likely renting out as full offices to maximize revenue which is actually not allowed.

I thought I reply to close this out, the debate on this approach is never ending. DYODD as you said.

Keep up the bloG!

“I asked the question what if interest rate rises, the answer from Germanie Chow was rental income will rise accordingly. Do you agree with her?!”

Thanks for your reply! We just hope our friends and family members can be prudent with money. Take good care of money and it will take good care of you.

Something I disagree with Ms Germanaie’s calculation. Her formula adding cash income with mortgage and ROI calculated base on that total figure divided by down-payment just doesn’t make sense. If like that, then many asset classes out there outperformed industry property.

Likewise, property of depreciating lease is hard to sell and even possible to sell at lost isn’t?

Can you explain where does the (200k x 30) come from in your ROI calculation?

$1.16m/ (200k x 30) = 19.3% ROI

And this one too:

ROI = 816k/(200k x 300) = 13.6%

Thanks.

Hi Don,

This is based on what I copied from their explanation back then.

//

Can you explain where does the (200k x 30) come from in your ROI calculation?

$1.16m/ (200k x 30) = 19.3% ROI

//

If I remember correctly, 200k is the down payment and they explained that it is for 30 years. They are presenting this in a way as opportunity cost of $200k.

$1.16m/ (200k x 30 years) = 19.3% return

//

And this one too:

ROI = 816k/(200k x 300) = 13.6%

//

Apologies, there is typo, I will correct this in the main text. It should be 816k/ 200k x 30 years = 13.6%

Don, it does make financial sense to me as well. Seems like a misrepresentation formula.

Tenants paying rent is based on size/type/location. Not on FH/999/99 or 60/30 leaseholds. Industrial properties come normally at 60years leasehold, thus the purchase price is much cheaper as it is only 60 years at start. It will depreciate much quickly. With less than 60 years lease, bank loans & CPF usage will decrease. that’s why ROI at double digits seems high esp at beginning

You can also learn how to get on the MAS Blacklist from Germaine! I’m sure it’s fun

haha no thanks!

Rental $4,000/month

Mortgage $800k -> $3k/month

Cash flow = ($4k – $3k) x 12 months x 30 years = 360k

$360k + $800k = $1.16m

$1.16m/ (200k x 30years) = 19.3% ROI

This is so naive , there are so many hidden factors for a property loan , interest will rise and that does not mean rental will rise as well , interest might rise while rental rates might drop , for a 1 million loan does not mean $3k instalments per month , it depends on your age when you take the loan and commercial interest rates tend to be higher and fluctuates after 2 years, if you are lucky enough to get a $4k rental , and paying a $3k bank loan instalments , there are property tax , bldg maintenance fees , hidden maintenance fees you might did to fork out especially the older properties plus agents fees , average out per month easily $500-$700 dollars per month , on top of that there might be vacant period where you are paying the entire monthly instalments in full for a month or more , the only benefit if you purchase the right property , the price might appreciate to an certain extend or it might also depreciate , quite common for commercial properties .

Hi Chris,

You can check out SG Budget Babe’s latest blog here to see both sides of the stories. I think she provided a fair view on IQuad and Marko.

https://www.sgbudgetbabe.com/2020/03/is-i-quadrant-scam-no.html

High risk high return 🙂

Stay healthy!

Best regards,

Jason

I am sorry but the calculations are all wrong. Returns must be annualised and discounted over a risk free rate. If you earn 30% over 10 yrs vs 30% over 2 years – its a very different set of returns. Beware of high rental yields – it gives you short term rewards but you end up with a lemon property that is hard to dispose. That is why good propoerties have low rental yields (eg shophouses) – as their capital value is sustained. No one should use high leverage without understanding what they are buying. Dont be fooled.

I paid for M&F and under their 1 year support program via telegram. They are pretty much like TIQ… but I can say most of the people who spent on this course felt cheated. I dont think this is considered educational course… more like sharing session where everything can be learnt in 1hr or less. Trust me… The rest are just playing games like team building…in this 3 days course. Waste of time and the main aim is conditioning students to invest their cash in industrial properties.

The reason is M&F are just creating the investment industrial property market for themselves & his community. To find people. willing to part their cash.., selling the dream of going for holidays and collecting passive rental income marketed as “boring landlords”…. do you actually think they are boring?? And whats the purpose of teaching so many students?? If 1 student is being charged $3k – 5k and fees, 100 students per group will meant half a million to Mr. Marko & friends yah.. In a year can you imagine how many people is being enticed by greed? Mr Marko is a millionaire yearly :).. And not everyone will take action to invest as time passes by as people felt fishy… so only 1 or few will manage to swim through as 1 of his live examples that he will use him/her to market in his FB as successful students owning “multiple” properties…. Of course many who commented positive things in his FB comments are existing cash/loan partners who already park their $ or have some form of partnership agreement yah…of course have to support right…

The “volunteers ” on actual course days are earlier batches of marko students who came to help @ his 3-day course.. some owns Porsche but are actual pre-own renewed COE Porsche which cost less than a new Japan/Korean car to show-off the new students that they are successful.. So ….. invest in me.. park your lump sum cash with me..be my cash partner… M&F call it the money magnet. coz it attracts investors as-if you are successful living a high life.

These earlier batch students who came dont serve the community for free. They come with agenda.. to look for potential cash partners like you and I or you can say “investors or fishes” who do not know whats the actual plan they are cooking behind.

In fact the students are their prospects and minions to find good quality bmv industrial properties in singapore..as all potential industrial leads need to be screened through by 1 of their senior batch student – Joo Hong.. He will see if this unit is being booked by other students. But in actual fact they may be keeping for themselves because no one knows if they are really booked.. only marko admins knows. They will just tell the students to move on and find another industrial property.. So imagine if you found a industrial property giving you more than 10% rental yield and you ask for verification, they will say its being booked and told to move on.. so how will you feel??? 🙂

As mentioned in earlier posts by other people, Marko markets as he owns multiple properties. In fact they are all co-shared by different investors. So this is wrong… this is technically breakdown into 3 areas to buy industrial property,

1. cash partner (gets 40% frm rental yield)

2. loan bearer (gets 40% frm rental yield)

3. deal + resource finder (gets 20% frm rental yield)

So basically, if you have no cash or cannot secure loan, you just be a deal finder to keep finding good below market value industrial properties. walk he ground.. do the dirty work.. And you get a share typically 10% to the person who finds the deal. The other 10% goes to being able to find cash and someone who can get the bank loan.

So technically you contribute hardwork, like a minion runner or like an asset manager some sort & you get 20% of the rental yield for not parting your cash and bear loans…thats why M&F students is constantly looking for cash partners and young people who can get loans which can loan for max tenture.

Next they will also teach you to stay in land-properties which you do not really own it but stay in it through rental… Basically you buy a good condo in town or near marina bay etc and you rental out to pay for your landed rental thats it ….

That is good insight. The early batch students will also position themselves as financially free on the FB or IG, driving Porsches, spending time with family when people are working…Everyone has his/her own agenda.

We need to question ourselves why are they doing this?

Why are they conducting this training?

This is true .I graduated from Marko class a year ago..and until now I regretted this decision to join his class .paid 5k and all he does is to sell u dreams and dreams throughout the 3 days.nothing new and nothing important.tried to find all possible ways to squeeze u dry.after graduation advance course ,than if got lobang to intro ,they want to charge u as well..basically in my opinion ,he will do what he can to find ways to earn more money from students.even in his course he arrange credit card people to let us apply .and from there I definately believe he got referral for doing that

To conclude …this is really the worst investment I ever made attending his course.

Appreciate . Very insightful. Thank you.

Thanks for your information. It’s similar of my view too. The cost now increase to 10k ady.

To collect $5k per student and $500k fees from 100 students squeezed into a 3 day course. This is good business.

The character of the trainer is important, Are his advices good for you or his organisation?

If it is your first property investment, do consider attend courses from Patrick Liew / propertysoul.

Hi Property Investor,

Can you share with me broadly what did you learn from Patrick Liew? How much does he charge?

Your calculations are in a mess. Sloppy presentation

Apologies for that. I will try to be better in the future. That’s like 3 years ago and they did not allow photo taking then.

I think buying S-REITs (Singapore Real Estate Investment Trusts) is a better alternative; been doing so for 8 years. Last year was a good time to buy. Now after vaccination program for COVID-19 rolled out, stock market is normalizing. I prefer S-Reits as they are more passive than being a direct landlord. But to each his own bah.

Hi Kenny,

I agree with you that S-Reit is a better source of passive income. There are fewer headaches and effort. I am helping my parents to manage their condo unit, the maintenance of the unit is always a headache as tenants will negotiate with you hard when they are about to renew the lease. To lease out commercial property will be a different ball game on its own, with its own challenges.

As investors of S-Reits, you will agree that there’s still work to be done to monitor the financials.

Good sharing and insightful from many comments here.

Owning multiple properties look good on surface but the initial cash outlay, mortgage loan debt, maintenance fees, vacant tenancy if no tenants are heavy expenses. Thankful after retrenchment this year, manage to generate my regular decent passive income thru Fixed Income Bonds like Shangrila Hotel / Fraser Property, USD /SGD FD and one rented property and I am happy with my own investment. I am the risk averse type Thus, my advise is you still need to do your own homework well. Never relay to much on these so called experts.

With passive income, you can take your time to find your next role. Onwards to FI!

HI Can i know whether marko’s course teaches how to select a good industrial property?