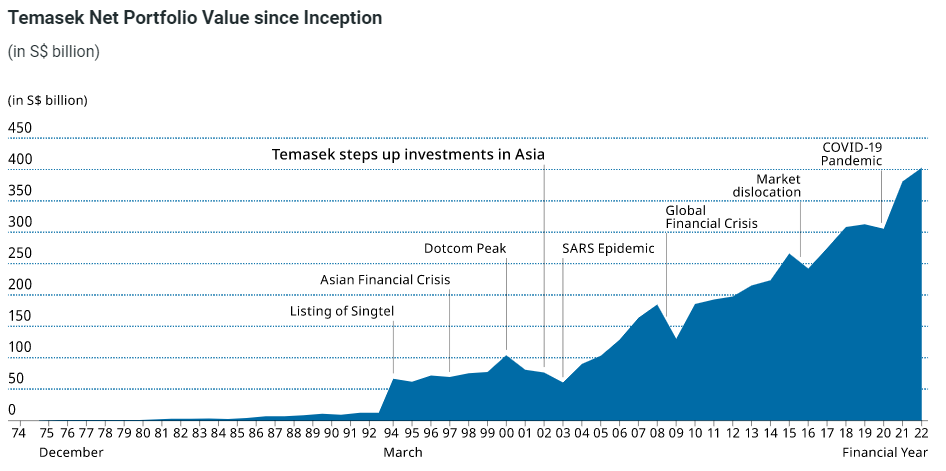

Temasek started its portfolio in 1974 and has grown with Singapore. Some companies like Singapore Airlines and Singapore Zoo have developed into our iconic brands. Temasek has evolved from the industrialized sectors into science, automation, and sharing economy.

Temasek’s portfolio has been around for 50 years. They had experienced various crises such as the Dotcom crash, SARS, Global Financial Crisis, and COVID-19. We need to invest for the long term, it needs to be a 30 – 50 years mindset and not a get-rich-quick mentality. Also, we need to put our funds out there and it will be subjected to all the market forces. There will be bound to experience a short-term (1-3 years) downward trend. Temasek experienced a drop from the year 2000 till the year 2003 during the Dotcom crash. Over the long run, the portfolio still rises, and short-term pain is inevitable.

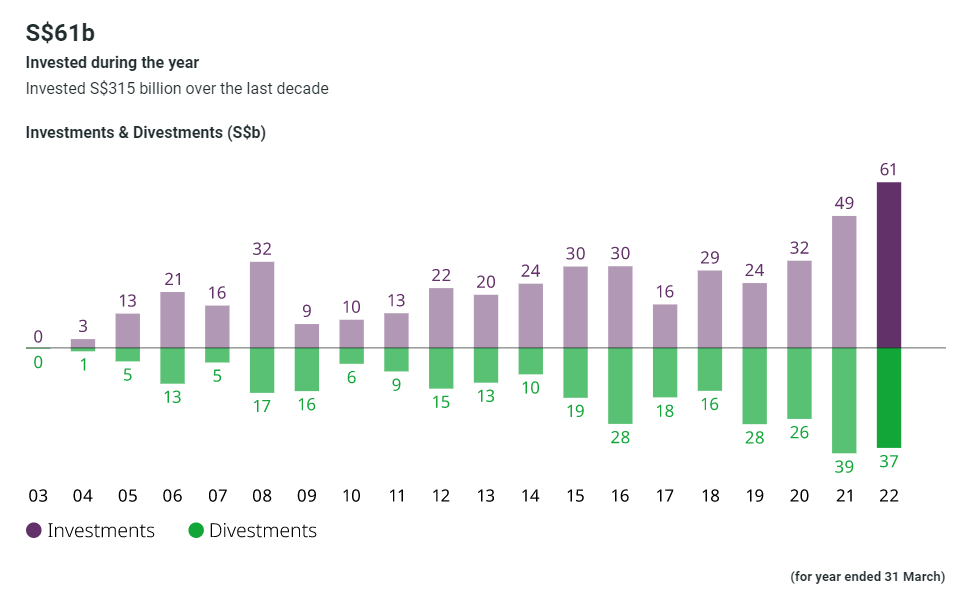

Rebalancing is a must. We need to trim our portfolio, weed out the losers and buy more winners. Over the long run, your portfolio will become stronger.

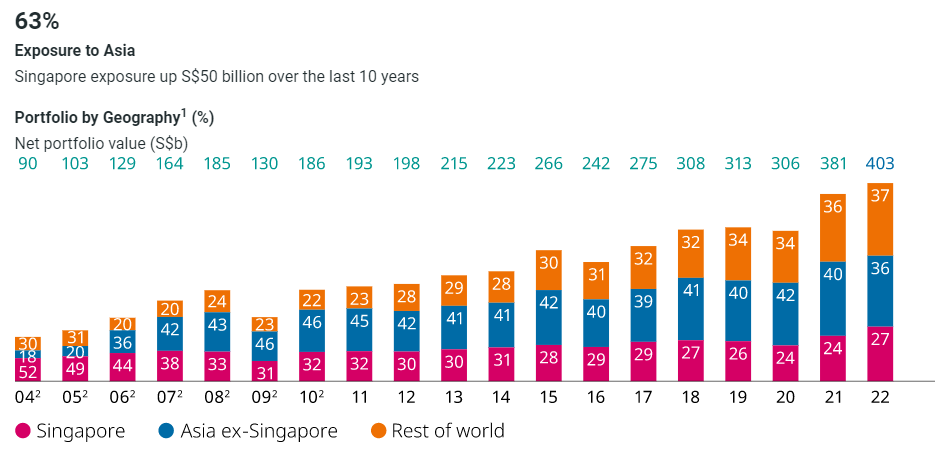

It is important to diversify your investment and not to have home bias. Temasek is investing more than 70% of the portfolio outside Singapore. As investors, we should diversify and gain exposure to the rest of the world. There are lots of opportunities globally and there are stronger companies out there to invest in.

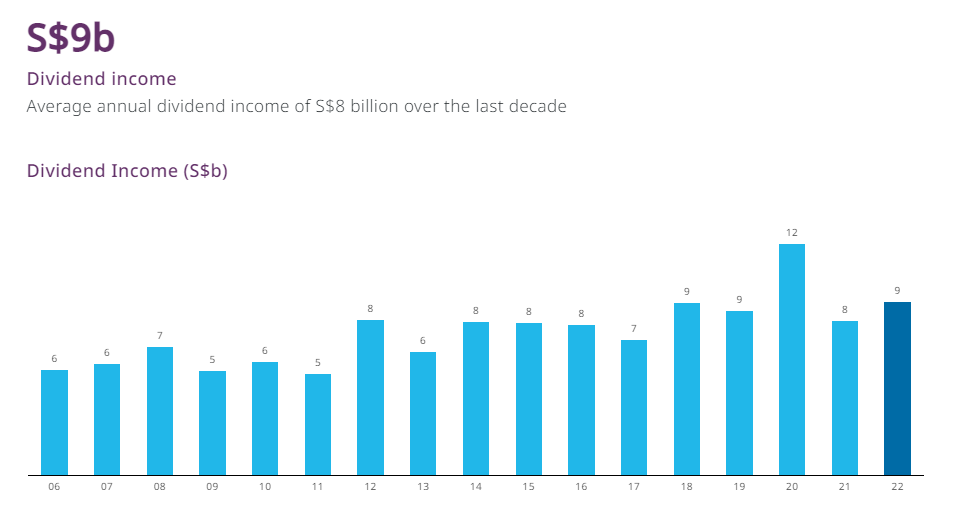

Temasek has steadily grown the dividend income for cash flow purposes. This is akin to your investment journey. If you are at the life stage when you do not require cash flow but want to grow the capital, you may choose to have more growth stocks in your portfolio. Say you are 40 years old and above and want to have a more diversified portfolio, you may want to have more dividend stocks and REITs to balance with the growth stocks. As we age, we will want to tilt the balance more towards interest from bonds, dividend stocks, and REITs while reducing exposure to growth stocks.

Leave a Reply